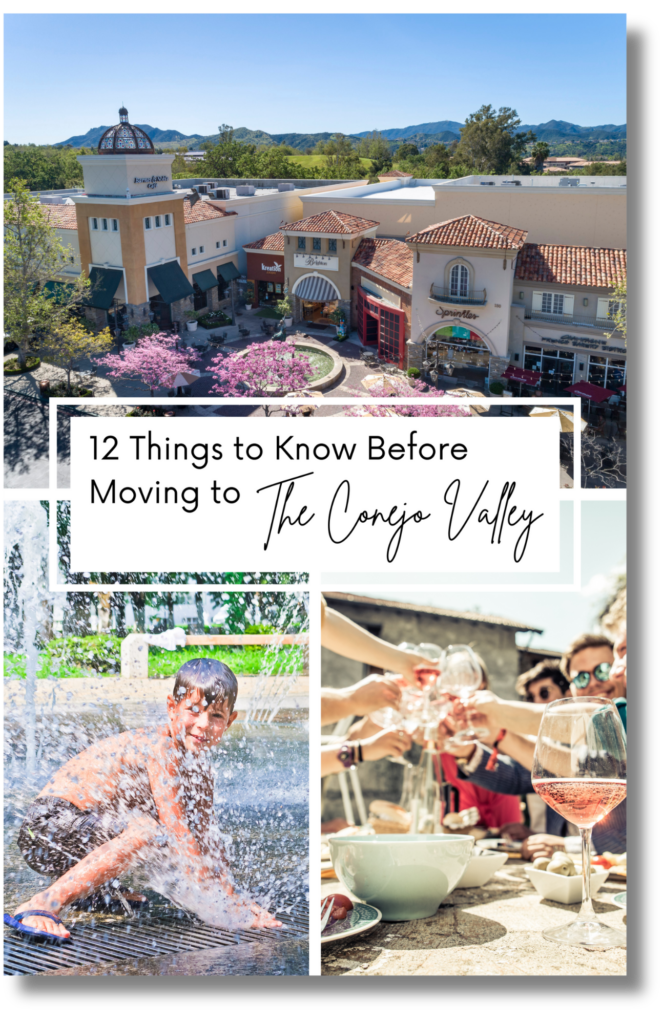

WHAT TO EXPECT IN 2025

Finding your new home is an exciting journey! As you prepare for your move to the Conejo Valley, it’s important to follow the current market trends and how they might influence your decisions along the way. MY GOAL: To help you understand the local market and find a home you’ll love.

Below are some common concerns that many homebuyers have, along with my tips on how to best position yourself to make informed choices when finding and purchasing your next home:

Conejo Valley Guy

Hi, I’m Michael.

I follow local market trends so you don’t have to – sharing my expertise along the way.

As a Realtor®, I can help you find and buy your new Conejo Valley home, guiding you from start to finish.

.

MORTGAGE RATES ARE TRENDING DOWNWARDS

2025 Q2 RECAP: Rates kicked off Q3 with a 3 month low hitting the mid 6s.

2025 FORECAST: Fannie Mae anticipates rates around 6.5% by the end of 2025. Many other forecasters agree.

💡 MY ADVICE

- It’s wise to accept that rates in the 6s are the “new normal” and to plan accordingly.

- Waiting for a significant rate drop in an already appreciating market may lead to increased competition from other buyers driving prices up further.

- REMEMBER: Purchase price is forever, mortgage rates can be temporary.

_____ _____ _____

YOU’LL NEED TIME TO SHOP FOR A LOAN

Financing is often the biggest hurdle for buyers, but lenders are eager to work with you. New loan programs make rates more manageable.

💡 MY ADVICE

- Minimally, get pre-approved for a loan before you start house hunting.

- Talk to at least one big bank (BofA, Chase, etc) and one mortgage broker. The big banks are best for highly qualified buyers with fully documented income. Mortgage brokers are best for everyone else. But it’s still good practice to talk to both no matter your situation.

- Going one step further and getting a fully underwritten pre-approval ahead of time can greatly increase your negotiating power when competing with other buyers.

_____ _____ _____

HOME PRICES ARE EXPECTED TO RISE

Lower mortgage rates are bringing buyers back to the market which is expected to cause home prices to increase.

Q2 CONEJO VALLEY UPDATE: Median prices ended June at $1,170,000, relatively flat over the last 12 months.

FORECAST: The California Association of Realtors predicts a 4.6% increase in 2025, while Conejo Valley may see even higher growth.

💡 MY ADVICE

- Demand for Conejo Valley homes remains relatively high, but way below peak activity. With limited inventory and no plans for large new home developments, steady price increases are expected to continue. Think long term.

- Timing the market is more luck than strategy—consider buying when you’re ready vs. trying to time dips in mortgage rates.

_____ _____ _____

INVENTORY IS IMPROVING CREATING A BALANCED MARKET

💡 MY ADVICE

-

Inventory is rising quickly — outpacing last year at this time — though it remains below historical averages. We expect it to continue climbing and likely peak around May or June.

-

While some homes are still seeing multiple offers, move-up and downsizer properties are selling faster than first-time buyer homes, as affordability challenges continue to impact entry-level buyers. Plan accordingly.

_____ _____ _____

YOUR COMPETITION ISN’T WHAT IT WAS

In other words, it will be easier to buy in 2025 than it was in the last few years. The frenzy of selling on a weekend with dozens of offers over asking price is behind us…for now. While multiple offers are still common, the competition is less intense. Instead of competing with 10+ buyers, you’re likely looking at closer to 1 or 2 – or none at all.

💡 MY ADVICE

-

Sellers still aren’t biting on lowball offers — most know inventory is tight and are willing to wait rather than settle for less.

-

But if a home’s been sitting for 30 days or more, chances are the price is too high. In those cases, sellers are usually more open to talking numbers and working out a deal.

_____ _____ _____

OBTAINING FIRE INSURANCE CAN COME WITH CHALLENGES

The horrific fires that struck Southern California in January put more pressure on an already challenging situation. Unfortunately, this is an issue that’s not going away any time soon.

💡 MY ADVICE

- If you find a home you are considering making an offer on, contact an insurance broker ahead of time to get an idea of the insurability of the property and a ballpark price estimate – especially homes by hills and/or open space.

- WORST CASE: Buyers can utilize the fire insurance provided through the California Fair Plan as a last resort.

_____ _____ _____

SELLERS ARE MAKING CONCESSIONS AGAIN

The days of buyers waiving contingencies up front and offering extras to win a deal are gone…sellers are now more willing to negotiate repairs or other terms.

💡 MY ADVICE

- Sellers in both Ventura and L.A. Counties are only required to do 3 things: strap the water heater for earthquake safety, install smoke detectors, and install carbon monoxide detectors. That’s it. Everything else is negotiable.

- However, broken items and safety concerns are fair game. Don’t hesitate to ask for repairs or concessions—most sellers are open to reasonable requests.

_____ _____ _____

AGENT COMPENSATION RULES HAVE CHANGED

Agent compensation has always been and remains negotiable. Key changes went into effect August 2024:

- Buyers and their agent must now sign a Buyer Representation Agreement – a legal contract outlining the services provided, obligations, and the terms of compensation.

- Sellers can still offer compensation to the buyer’s agent, but it won’t be displayed in the MLS

.

💡 MY ADVICE

-

Sellers traditionally cover the buyer’s agent’s fee, and this is still the norm in most cases.

-

If a seller offers less compensation than what’s stated in the Buyer Representation Agreement, buyers would cover the difference—often by adjusting their offer price.

-

Before signing a Buyer Representation Agreement, I will provide a free consultation to showcase my expertise and explain how I can guide you through finding and purchasing your next home with confidence.

.

SO…CAN YOU EXPECT TO BUY A HOME IN 2025?

Yes! The housing market is rebounding, and opportunities are emerging. By taking time to understand the market and set your expectations now, you’re already one step ahead…lean into the excitement of the journey.

3 STEPS TO FINDING THE HOME YOU’LL LOVE

STEP 1

FIRST MEETING: After our initial call, we’ll set up a time for us to meet in person or over Zoom. During this meeting, we’ll go over a map of the Conejo Valley, I’ll give you an overview of our 5 towns and we’ll discuss the nuances of each one. We’ll also go through my Buying Guide, and have a more detailed conversation about what you’re looking for, and discuss the home buying process in CA.

STEP 2

AREA TOUR: If you’re new to the area or need a refresher, we’ll take a drive through neighborhoods that might be a good fit and visit local amenities. There’s no cost or commitment, just a chance for you to get a feel for the community.

PROPERTY TOURS: The fun part…and your chance to visualize yourself living in your potential new home. I’ll be there to offer insights, answer questions, and point out anything that might not be obvious—helping you make a confident, well-informed decision.

STEP 3

SUBMITTING OFFERS → GETTING YOUR KEYS: Negotiating offers and navigating escrow can be complicated. As a full service agent, I work for you. I am your advocate, guiding you through the process, helping you avoid pitfalls, and ultimately finding a home you’ll be happy in for years to come!