Market Update April 2022

Westlake Village, Agoura Hills, Oak Park, Thousand Oaks and Newbury Park

By: Michael Rice | April 1, 2022

Released April 1, 2022

My View From Inside

Let’s discuss the most common questions on home buyers’ minds these days.

Where are interest rates headed?

Mortgage rates have jumped from the mid 3s to mid 4s over the last couple months. That’s significantly higher than most industry experts were forecasting. Rising inflation, the Federal Reserve’s actions, and geopolitical uncertainty are the main driving factors.

But don’t expect rates to come back down. According to Bankrate.com, the consensus opinion amongst industry experts is for rates to continue up although at a slower rate throughout the rest of the year.

“Mortgage rates are likely to continue to move higher throughout the balance of 2022, although the pace of rate increases is likely to moderate.”

– Len Kiefer, Deputy Chief Economist, Freddie Mac

To offset the rise in both interest rates and home prices, many buyers are considering adjustable rate mortgages that are fixed for 5 or 7 years that are currently approximately 3.5%.

Are we in a real estate bubble?

With home prices increasing about 20% a year, the bubble question is a fair concern. Some buyers are taking a “let’s wait it out” strategy in hopes that rates, prices, or both come down. That’s unlikely to happen anytime soon.

Forbes recently posted an article addressing this bubble concern. It cites several reasons why a bubble is unlikely. Here are a few of the points it covered.

- Lending standards are much stricter than they were during the 2000s and credit scores for borrowers are significantly higher (+42 points) than they were pre housing crisis.

- Home owner equity is substantially higher than it was pre-crisis. Back in 2007, many buyers purchased with little or no down payment. And many homeowners who had equity used it as their personal ATM. That’s no longer the case.

- Housing supply is at historically low levels. New home construction has lagged population growth for years. And the largest generation of home buyers has entered the “household formation age” only adding to the supply shortage.

When will the Conejo Valley get more inventory?

As harsh as this may sound, it’s time to move past this question. No new large-scale construction is planned for the Conejo Valley and the work-from-home economy has only added to the demand for housing in the area as many people leave the big city for a simpler lifestyle.

The “move-up” and “downsizing” sellers are few and far between. Most sellers move due to circumstances, not choice, leaving buyers waiting for sellers to get a job transfer, divorce, pass away, or retire to another state.

Bottom Line

The forecast for home prices is to continue up for at least the next 5 years. The best advice I can give is to get comfortable being uncomfortable. It may take you several attempts to get an offer accepted and you’ll have to be willing to go all in to win. This is the market for the foreseeable future so it’s best to be prepared going in.

For more tips check out: 12 Home Buying Mistakes to Avoid in 2022

April 2022 CONEJO VALLEY REAL ESTATE MARKET UPDATE

- The hot market continued in spite of rising interest rates (approx 4.5%).

- Conejo Valley median home prices jumped 24% in March to $1,072,500 (+207k) vs last March posting the 21st straight month of price gains.

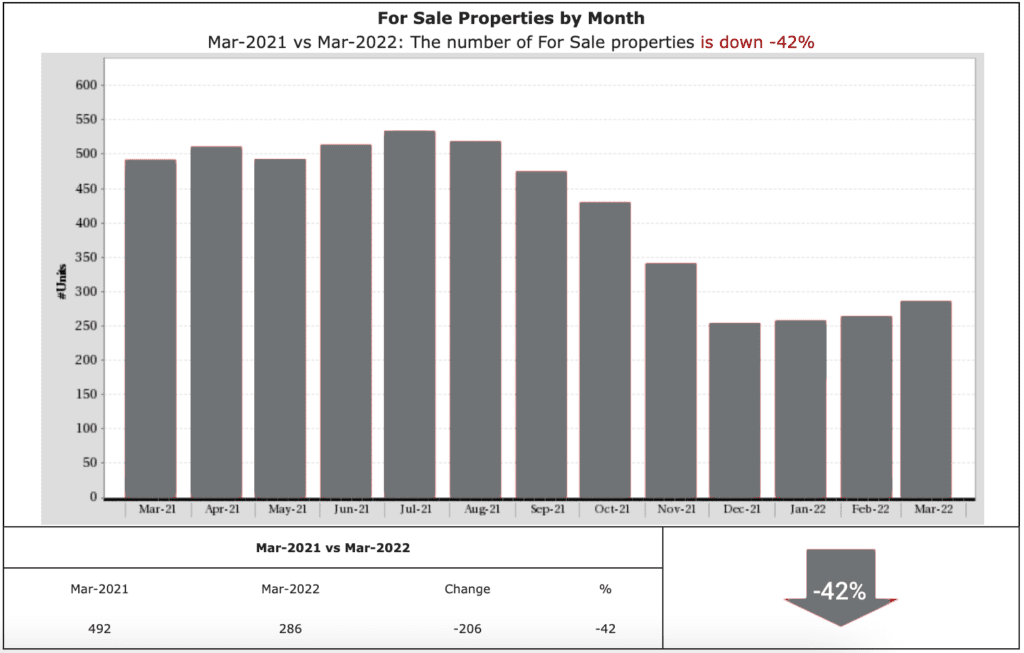

- Lack of inventory of available homes continues to be our biggest challenge with only 286 homes for sale in the Conejo Valley, down 42%.

- And that’s likely to continue throughout the rest of the spring.

What Should We Expect Going Forward

- Expect competition to intensify as rising prices and interest rates encourage buyers to act now

- Inventory will steadily increase as we get into spring.

- Although inventory is down vs last year, it’s up slightly vs last month.

- Multiple offers and bidding wars will continue to dominate the market. Be prepared to act quickly and creatively when a good house hits the market.

What's The 2022 California Forecast?

According to the California Association of REALTORS

- The median price of a home is expected to increase 5.2% in 2022.

- The number of home sales is expected to decrease by 5.2%.

- Interest rates are expected to average 3.5% on a 30 year fixed mortgage.

Market Snapshot

Price

- The median price of a Conejo Valley home was up in March at $1,072,500.

- That’s now 21 consecutive months up.

- Prices are up 24% from $865,000 last March.

- And down $27,450 from last month.

Homes for Sale

- March ended with 286 homes for sale.

- Down 42% from last March.

- That’s 206 fewer homes than last year.

- And 45 more homes than last month.

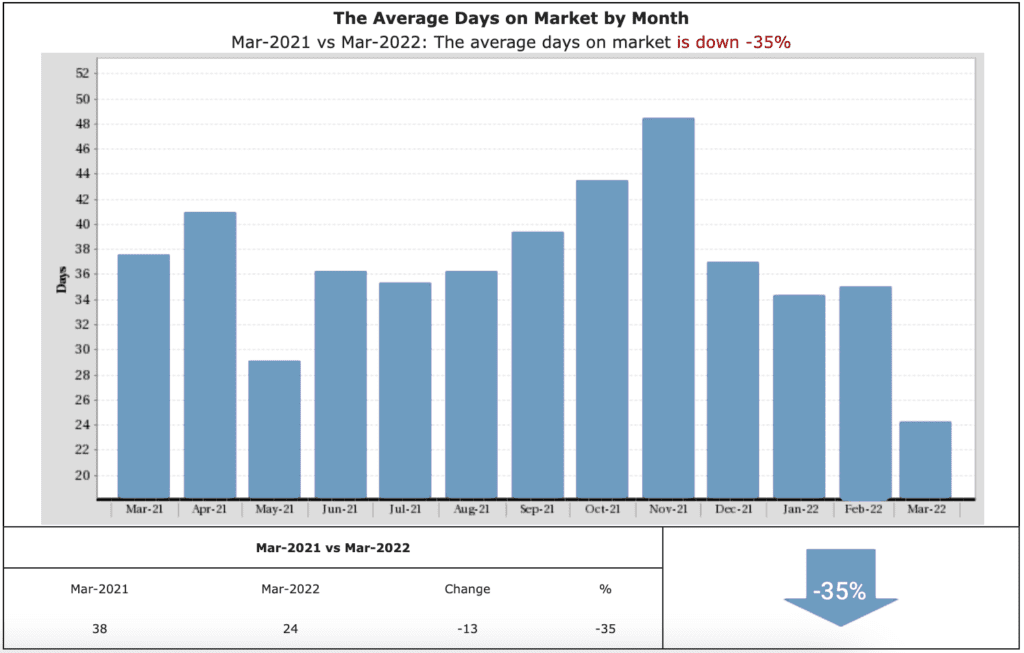

Days to Sell a Home

- It took 22 days on average to sell a home in March.

- Down 35% from last March.

- That’s 13 fewer days than last year.

- And 7 fewer day than last month.

Interest Rates

Median Prices by City

(Prices are for February 2022. City data is two months behind. Keep in mind that low volume of sales can cause large price fluctuations.)

| City/County | # Sold | Feb 2022 | Feb 2021 | Y-T-Y % Chg |

|---|---|---|---|---|

| Ventura County | 668 | $755,000 | $650,000 | 16.2% |

| San Fernando Valley | 814 | $865,500 | $745,000 | 16.2% |

| Agoura Hills | 20 | $969,000 | $935,000 | 3.6% |

| Calabasas | 34 | $1,600,000 | $1,637,500 | -2.3% |

| Camarillo | 72 | $789,500 | $675,000 | 17.0% |

| Moorpark | 46 | $780,250 | $795,000 | -1.9% |

| Newbury Park | 34 | $1,000,000 | $820,000 | 22.0% |

| Oak Park | 12 | $1,017,500 | $770,000 | 32.1% |

| Simi Valley | 123 | $775,000 | $640,000 | 21.1% |

| Thousand Oaks | 72 | $974,000 | $717,000 | 35.8% |

| Westlake Village (Ventura County) | 18 | $1,400,000 | $1,117,000 | 25.3% |

| Westlake Village (L.A. County) | 2 | $1,805,000 | $1,250,000 | 44.4% |

| Woodland Hills | 57 | $1,181,000 | $922,500 | 28.0% |