Updated 10/22/2025

How Much Are Conejo Valley Property and Sales Taxes?

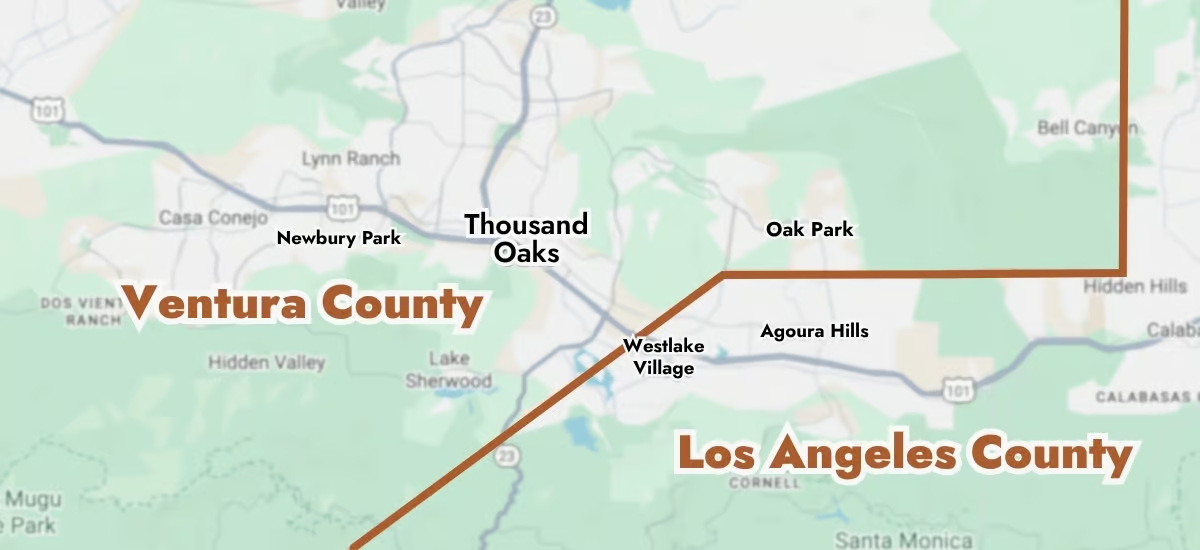

When you are looking to buy a home, taxes play a role in what you can afford. As a home buyer, you need to know how much our local taxes are and what is the difference between Ventura County and Los Angeles County. Since the county line runs right through the middle of Westlake Village, which county and city you live in will affect your taxes.

The two counties running through the Conejo Valley can be confusing. If you’re confused too, check out this post: The Nuances of Westlake Village and Thousand Oaks

Sales Taxes

| County | Sales Tax |

|---|---|

| Ventura County | 7.25% |

| Los Angeles County | 9.75% |

Property Taxes

Below is a general idea of what to expect to pay in property taxes in each city.

Important Note: 1% is the max that the county can collect. However, your local municipality can tack on additional fees like school bonds, special assessments for sewer lines, park improvement, etc. These assessments are not all reflected in the official “published rate” you’ll find online. They may also change or expire at any time so it would be very difficult to monitor every city/town. It’s probably safe to assume that the actual tax rate for each area will be closer to 1.25% give or take.

| City | Property Tax Rate |

|---|---|

| Thousand Oaks (includes Newbury Park and Ventura area of Westlake Village) | 1.0400% |

| Westlake Village (L.A. County) | 1.1063% |

| Agoura Hills | 1.1063% |

| Oak Park | 1.1642% |

| Calabasas | 1.0818% |

| Simi Valley | 1.0772% |

| Moorpark | 1.0751% |

What Can Cause Your Property Taxes To Change?

From the L.A. County Assessors office:

In 1978, California voters passed Proposition 13, which substantially reduced property tax rates. As a result, the maximum levy cannot exceed 1% of a property’s assessed value (plus bonded indebtedness and direct assessment taxes). Increases in assessed value are limited to 2% annually. Only four events can cause a reappraisal:

-

- A change in ownership;

-

- Completed new construction;

-

- New construction partially completed on the lien date (January 1); or

-

- A decline-in-value (see Market Value Decline – Prop. 8).

Tax rates can change regularly so you will want to check with the county assessors office:

Los Angeles County Assessor

Ventura County Assessor

Information deemed reliable but not guaranteed.

How do Conejo Valley communities compare? Read these posts next to find out:

- Where to Live in Conejo Valley | Westlake Village Vs. Thousand Oaks

- Where to Live in Conejo Valley | Westlake Village Vs. Agoura Hills

- Where to Live in Conejo Valley | Oak Park Vs. Agoura Hills

Whether you’re thinking about buying a home or selling your homes, I’m here to help! Get in touch today by filling out the form on this page, calling me directly at 818-384-9929, or emailing me directly at Michael@ConejoValleyGuy.com.