Market Update | December 2025

Westlake Village, Agoura Hills, Oak Park, Thousand Oaks and Newbury Park

(Not AI Generated!)

My View From Inside

It’s December which means it’s time to forecast what’s in store for the real estate market in 2026.

2025 in Review – Treading Water

2025 started off strong. Buyers who had grown tired of waiting for lower rates jumped back in, and homes were beginning to sell quickly again. Then…the tariffs hit, freezing the market for a couple of months and wiping out the momentum.

Sellers had to adjust fast. The “name your price and count your offers” market of years past shifted to one where major price reductions were often necessary just to attract cautious buyers. Price drops climbed to 50+ a week when fewer than 10 was normal not long ago.

Meanwhile, inventory – the thing we’ve all been waiting for – kept rising as homes sat longer, which kept prices essentially flat.

Overall, it was a rather forgettable year from a real estate standpoint. The market was fairly balanced between buyers and sellers, and mostly just treaded water.

Here’s what to expect in 2026.

Economic Scorecard Summary

(at a glance)

| 2025 Forecast | 2025 Reality | 2026 Forecast | |

|---|---|---|---|

| GDP | +2.0% | +1.7 to +2.0% | +2.0% |

| Mortgage Rates | 5.9% | 6.2% | 6.0% |

| CA Home Prices | +4.6% ($909k) | +1% ($874k) | +3.6% ($905k) |

| Sales Volume | +10.5% | +0.1% | +2% |

How’d We Do and Where Are We Headed

The Overall Economy

- 2025 Forecast: The U.S. economy was forecast to grow +2% in 2025 as economists believed we avoided a recession and achieved a “soft landing” (Recession is defined as 2 consecutive quarters of negative GDP)

- Reality: GDP is forecast to end the year around +1.7 to +2%, right in line with the forecast.

2026 Forecast: The latest U.S. GDP forecast is a +2% increase in 2026 as the hopes of AI investments paying off and the Fed continuing to cut rates. Inflation is expected to ease from 3.1% in 2025 to 2.6% in 2026 – favorable conditions for more rate cuts in 2026.

Mortgage Rates

- 2025 Forecast: Another rosy forecast from the CA Association of Realtors (C.A.R.) going into 2025 predicted mortgage rates to drop to 5.9% for the year.

- Reality: Mortgage rates peaked in April 2025 at 6.83% and ended the year in a nice downward trend to about 6.2%.

2026 Forecast: Once again, the forecast is for mortgage rates to continue downward. C.A.R. is forecasting rates to drop to 6.0% in 2026. Fannie Mae expects roughly the same (5.9%) by late 2026.

California Home Prices

- 2025 Forecast: C.A.R. expected home prices to increase 4.6% in 2025 to $909k.

- Reality: California home prices ended the year with a median price of $874k up 1% – well below the forecast.

2026 Forecast: C.A.R. forecasts home prices to increase 3.6% in 2026 to $905k.

Sales Volume in California (number of homes sold):

- 2025 Forecast: C.A.R. forecasted that 10.5% more homes would sell in 2025.

- Reality: The number of home sales in CA were down 0.1% to 269k homes sold. That’s a 39% drop in sales compared to the 444k home sales we had in the peak of 2021.

2026 Forecast: C.A.R. expects home sales to increase 2.0% in 2026 as more buyers accept the new “normal” 6% mortgage rates rather than waiting for a substantial change.

Bottom Line…

For Buyers: 2026 should feel more stable. Rates are expected to settle into the high-5s to low-6s, inventory should continue to build, and home price growth should stay modest. It’s not a complete buyer’s market, but buyers will have options again, and room to negotiate, especially on homes that have been sitting. Staying active and realistic will put you in a good position.

For Sellers: 2026 is all about strategy. With more inventory and cautious buyers, pricing right from the start and making sure the home shows well will make a big difference. The good news is that slightly lower rates should bring more buyers back, and clean, move-in-ready homes will still get strong attention. Sellers who adjust to the current market will see the best results.

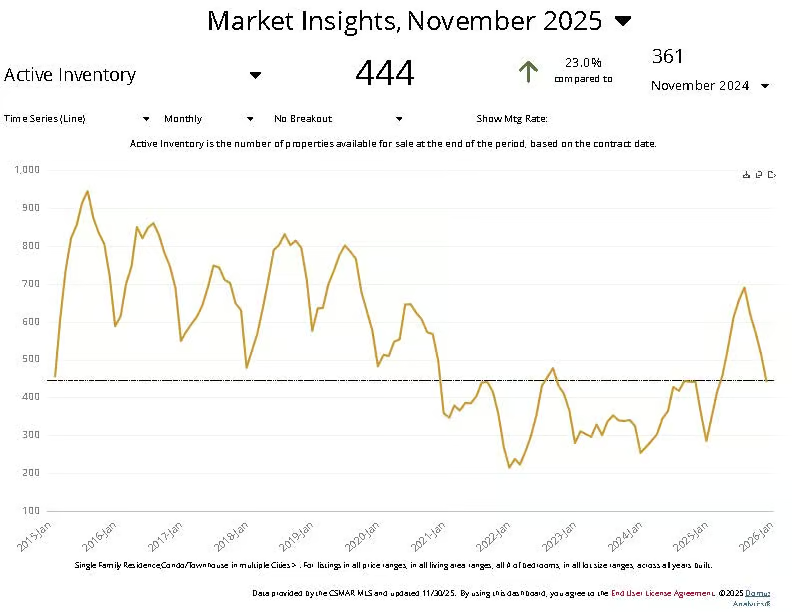

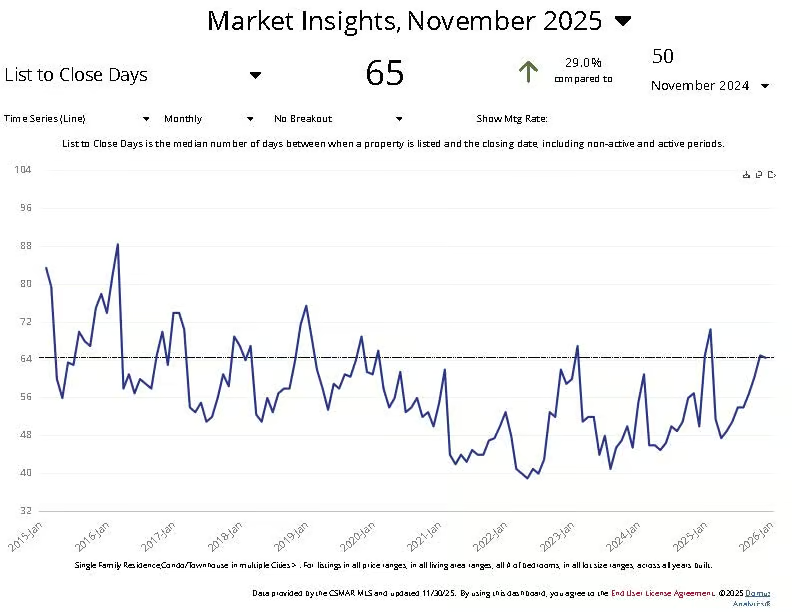

Local Snapshot | Conejo Valley | End of November

- 444 active listings, compared to 361 this time last year — a 23% increase

- Homes are taking longer to sell – 65 days on average vs 50 days last November.

- Expired listings doubled to 100 unsold homes for the month vs 50 last year indicating a divide between what sellers want and what buyers are willing to pay.

- Prices remain relatively flat, up 3% year-over-year, but bouncing between 1.1M-1.2M annually.

→ Median home price: $1,116,250

- Mortgage rates ended November at approx. 6.2% –down from 6.8% last year, and the lowest in 2025.

Ready to Make a Move?

Whether you’re buying or selling, the market is shifting—and strategy matters. Let’s connect for a quick, no-pressure conversation about your options.

Let’s talk: (818) 384-9929 | Michael@ConejoValleyGuy.com

Read: My Advice for a Successful Home Purchase or Sale This Year

Buying in 2025 Selling in 2025

Monthly Market Update - Delivered

Get the Market Update emailed to you each month!

"*" indicates required fields

Seller’s Corner

The rise in available homes is tilting the market away from sellers. We’re no longer in the red-hot seller’s market of the past. That’s why pricing your home right from the start is more important than ever. Today’s buyers are quick to jump on homes that are well-priced and move-in ready—but if you miss that initial window of interest, it can be tough to regain momentum later, even with a price cut.

What's The 2026 California Forecast?

According to the California Association of REALTORS

- The median price of a home is expected to increase 3.6% to $905k in CA.

- The number of home sales is expected to increase 2.0%.

- Interest rates are expected to average 6.0% in 2026.

Market Snapshot

Home Prices

- The median price of a Conejo Valley home was up in November to $1,116,250.

- That’s up 1 month year over year.

- Prices are up 2.9% from $1,085,000 last November.

- And up $11,250 from last month.

For Sale

- November ended with 444 homes for sale.

- Up 23% from last November.

- That’s 83 more homes than last year.

- And 58 fewer homes than last month.