Market Update | September 2025

Westlake Village, Agoura Hills, Oak Park, Thousand Oaks and Newbury Park

By: Michael Rice | September 2, 2025

(Not AI Generated!)

My View From Inside

The Dilemma Home Buyers Face Today

→ Do you wait for mortgage rates to drop and hope that prices stay flat when they do?

→ Or do you buy now and hope to refinance in the next year or two?

No decision comes without risks and tradeoffs and deciding when to buy a home is no different.

The “Wait for Rates to Drop” Strategy

Pros

- Lower rates = lower monthly payment with no future refinance costs.

- If home prices remain flat when rates drop, you’ll be able to afford more house.

- If rates don’t come down anytime soon and inventory continues to climb, prices may drop significantly (possible outcome, but minority opinion).

Cons

- Home prices may not drop or even stay flat. If demand surges when rates dip, prices are likely to climb and erase any savings.

- You could miss out on today’s increase in inventory and low competition. After experiencing markets with low inventory and high demand, losing out to other buyers in a competitive market is no fun.

- Uncertainty on timing: rate drops have been predicted since rates shot up a few years ago, yet they’ve stayed in the mid-6s to low-7s. A drop remains the forecast, but no one has a crystal ball.

The “Buy Now, Refinance Later” Strategy

Pros

- We haven’t seen this many motivated sellers since 2008. Deals exist today that will quickly disappear when rates drop.

- While inventory is still lower than years past, demand is also lower, giving buyers more room to negotiate favorable terms.

- Your home price is locked in today, but you always have the option to refinance if/when rates do drop, lowering your monthly payment later.

- You start building equity immediately instead of renting or waiting. And rents have continued to increase in recent years.

Cons

- Higher monthly payments in the short term until refinancing which could take a year or longer.

- Refinancing isn’t guaranteed. Future rates might not fall as much as expected.

- You may have to pay closing costs twice (purchase + refi), which adds to overall expenses.

- If home values dip in the near term, refinancing could be harder.

Timing and predicting the market is tricky if not impossible. My advice to homebuyers: Buy when you’re ready and you find a home you love. That’s the only thing you can truly control.

Local Snapshot (Conejo Valley – End of August):

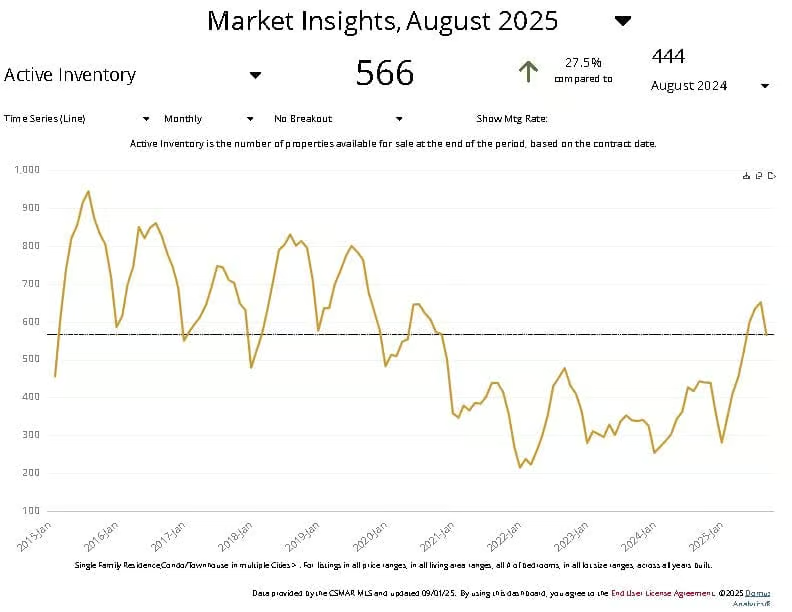

- 566 active listings, compared to 444 this time last year — a 27% increase

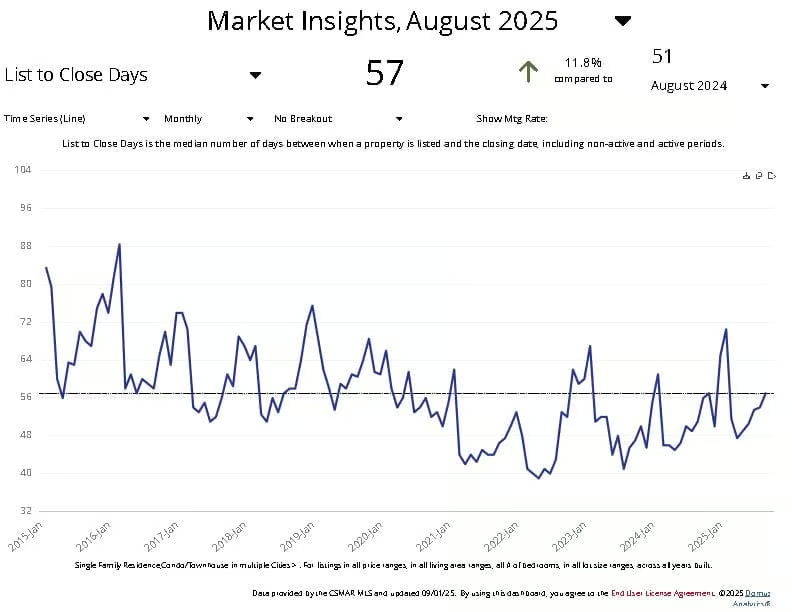

- Homes are taking longer to sell – 57 days on average

- Price reductions are more frequent, but are slowing now that sellers are adjusting to the current market climate. 50+ reductions per week has slowed to 20+ per week.

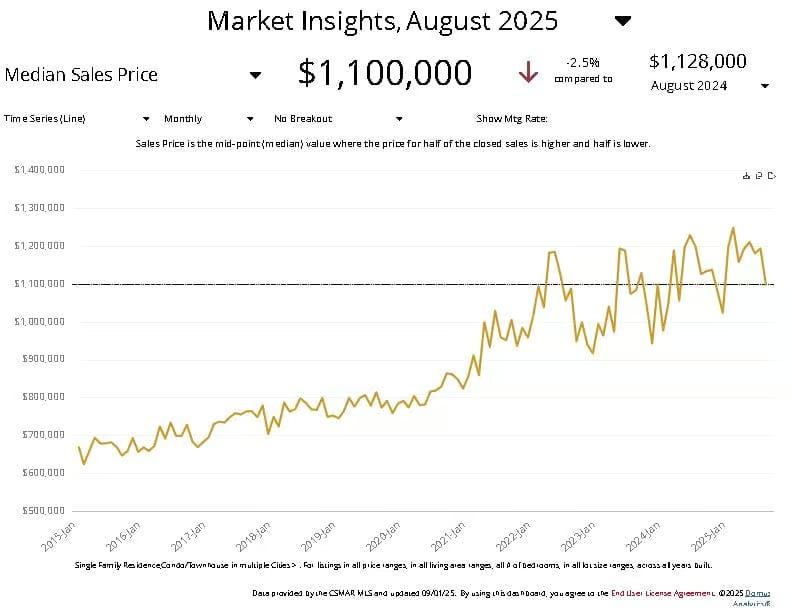

- Prices remain relatively flat, down 2.5% year-over-year, but bouncing between 1.1M-1.2M annually.

→ Median home price: $1,100,000

- Mortgage rates ended August at approx. 6.6% – no change from last year.

️ Bottom Line:

Buyers: Inventory is up and buyers finally have leverage. Waiting for lower rates could mean facing higher prices and bidding wars later. Buying now locks in today’s home prices with the option to refinance when rates drop.

Sellers: Homes aren’t flying off the shelf anymore. Buyers have more options and more negotiating power. Properly priced homes still sell, but flexibility and patience are key in today’s market.

Ready to Make a Move?

Whether you’re buying or selling, the market is shifting—and strategy matters. Let’s connect for a quick, no-pressure conversation about your options.

Let’s talk: (818) 384-9929 | Michael@ConejoValleyGuy.com

Read: My Advice for a Successful Home Purchase or Sale This Year

Buying in 2025 Selling in 2025

Monthly Market Update - Delivered

Get the Market Update emailed to you each month!

"*" indicates required fields

What to expect moving forward

- Expect to slight uptick in the market as the summer pause comes to an end.

- Mortgage rates should remain in the mid 6% range this month.

- Bargain shoppers may be in luck due to increasing inventory and motivated sellers who missed the busy season and still need to sell.

- Expect homes that have been sitting on the market for 30 days or more to take a lower offer. Don’t be afraid to try.

Seller’s Corner

The rise in available homes is tilting the market away from sellers. We’re no longer in the red-hot seller’s market of the past. That’s why pricing your home right from the start is more important than ever. Today’s buyers are quick to jump on homes that are well-priced and move-in ready—but if you miss that initial window of interest, it can be tough to regain momentum later, even with a price cut.

Market Snapshot

Home Prices

- The median price of a Conejo Valley home was down in August to $1,100,000.

- That’s down 1 month in a row year over year.

- Prices are down 2.5% from $1,128,000 last August.

- And down $72,000 from last month.

For Sale

- August ended with 566 homes for sale.

- Up 27.5% from last August.

- That’s 122 more homes than last year.

- And 58 fewer homes than last month.