After years of a crazy seller’s market with low interest rates, low inventory, and bidding wars, it was only a matter of time before the market shifted. What wasn’t expected was such a quick and drastic shift that seemed to happen overnight.

But before you give up on buying a home, consider the following…

The seller’s market is over, but not dead

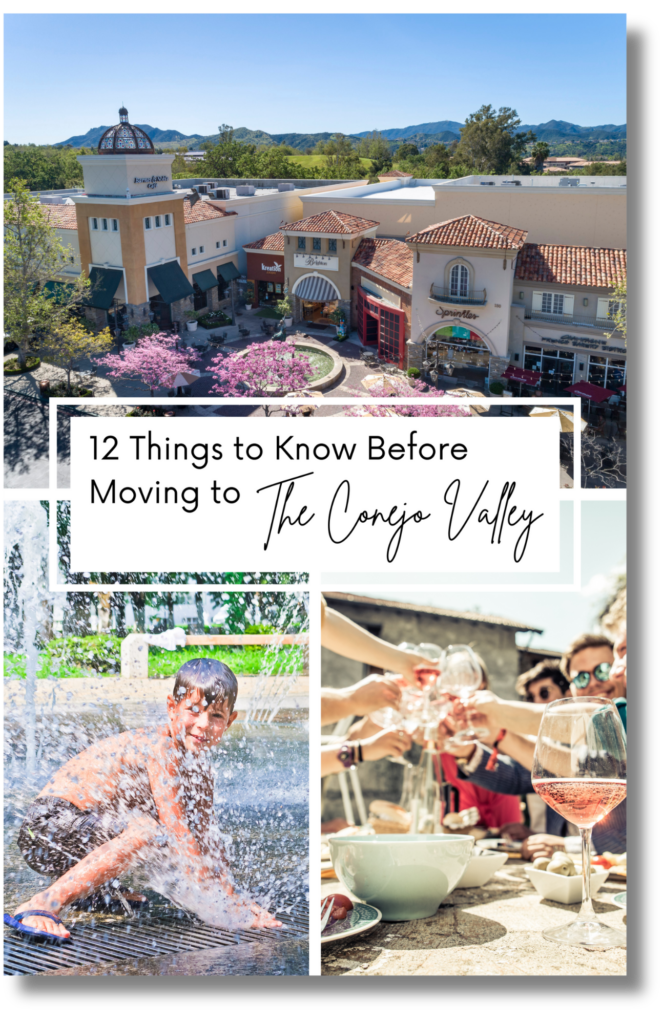

After the real estate market crash of 2008, many people equate a recession with a housing crash. That’s rarely the case (Read: Why 2022 isn’t 2008 Again). In fact, home prices have gone up 4 out of the last 6 recessions.

As the flight from the city to the suburbs continues, low inventory and high demand for the Conejo Valley keeps the market fairly balanced – but definitely tilting towards buyers in many cases. Some sellers are having difficulty accepting this fact which is often why you see homes sitting on the market and drastic price cuts. But if the home is priced correctly, it will still sell fairly quickly.

California home prices are expected to drop in 2023

The California Association of Realtors forecast home prices to drop 8.8% in 2023. The Conejo Valley typically performs better than state averages so don’t expect a drastic drop in local home prices next year. In fact, since May 2022, the Conejo Valley price correction has already been in full swing. With local home prices dropping over 20% since the peak in May, the major part of the price correction has likely already occurred.

The consensus opinion among most CEOs and economists is that we will enter a recession early 2023 that will last about 6-12 months and shouldn’t be too deep. You could argue the real estate market has already been in a recession since sales and prices have drastically dropped from the peak.

While housing is traditionally one of the first sectors to slow in a shifting economy, it’s also one of the first to rebound.

Low inventory will keep the market from plummeting

New construction and resales have lagged population growth for over a decade. With Millennials (our largest generation) now at home buying age, the low inventory issue has only gotten worse. And with many homeowners locked in at very low interest rates, most Conejo Valley homeowners only sell for one of three reasons: Moving out of the area, life circumstances (divorce, financial), or death.

We’ve been averaging about 300-400 homes on the market for the last several years. To give some perspective, we had over 2000 homes for sale during the market crash of 2008. Today, most homeowners have a lot of equity even after the latest price adjustment. The likelihood of a surge in foreclosures is very unlikely.

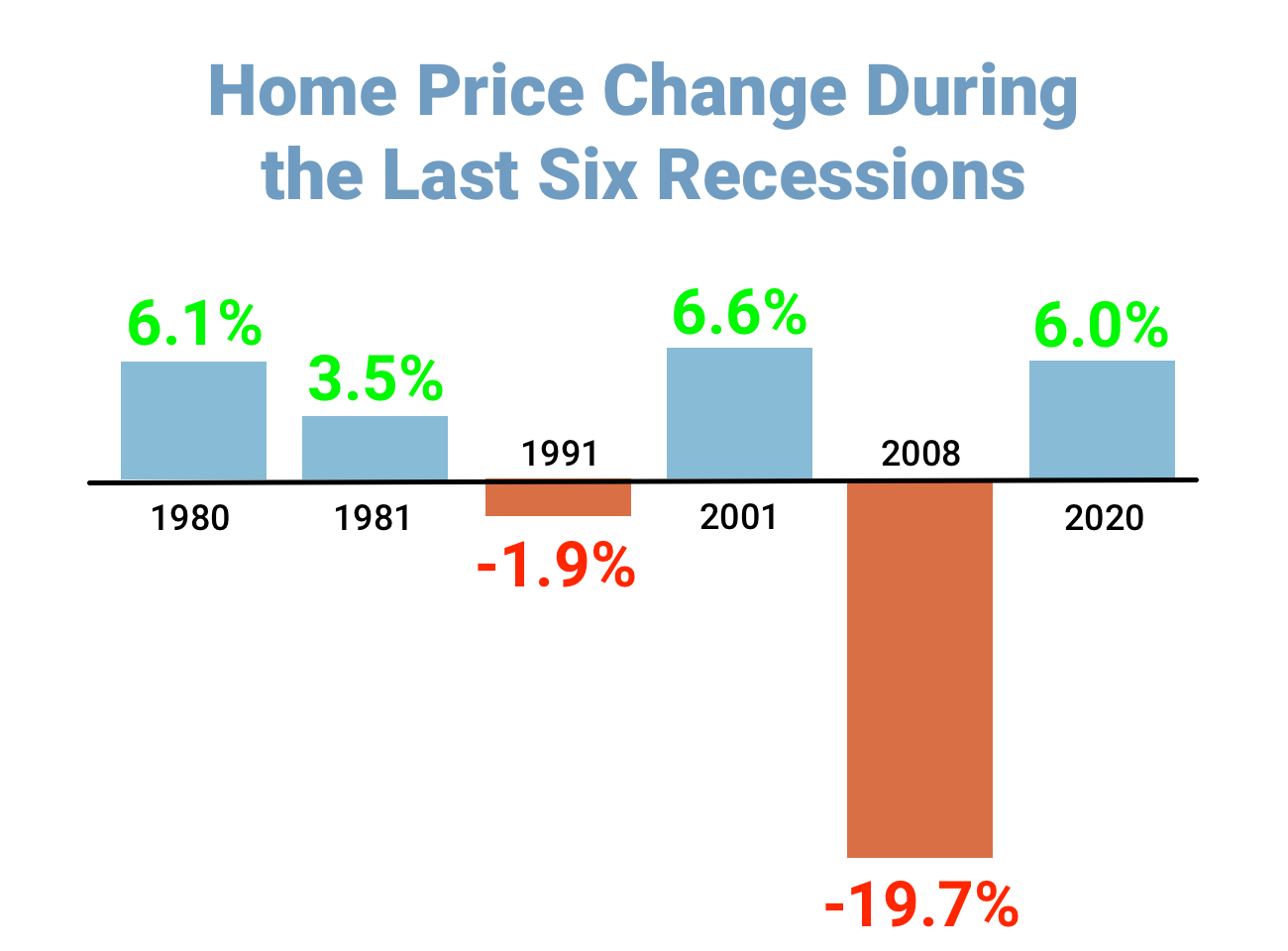

Many experts forecast a drop in mortgage rates in 2023

The Mortgage Bankers Association is forecasting mortgage rates to drop to 5.3% next year (from approx 7% today). The reasoning is that the Fed is acting aggressively to reduce inflation by raising interest rates. At some point the economy will slow to a point that will require the Fed to change course and reduce rates to avoid a deeper and more prolonged recession. A drop in mortgage rates next year will increase housing demand which can lead to a shift back towards a seller’s market.

Historically, mortgage rates fall during a recession.

Bottom Line…

You may be thinking, shouldn’t I just wait for rates to come back down? If the experts are correct and rates eventually begin to drop next year, all those buyers waiting for rates to drop will come roaring back to the market driving up prices and increasing competition again. Conversely, if you buy today, many sellers are getting desperate and will take a low offer. Yes, you’ll pay a higher rate today, but you’ll get a lower price and the ability to refinance in a year or so.